SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of

the Securities Exchange Act of 1934

|

Check the appropriate box: |

|

|

X |

Preliminary Information Statement |

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

|

|

Definitive Information Statement

|

|

WARP 9, INC. _____________________________________________________________ (Name of Registrant As Specified In Its Charter)

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

|

X |

No fee required |

|

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|

|

Fee paid previously with preliminary materials. |

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

WARP 9, INC.

1933 Cliff Drive, Suite 11

Santa Barbara, California 93109

NOTICE OF ACTION TO BE TAKEN BY

THE SHAREHOLDERS

JULY 22, 2015

To The Shareholders of Warp 9, Inc.

Zack Bartlett, William E. Beifuss, Jr., Greg Boden, Max Haws, Thunder Innovations, LLC, NewQuest Ventures, LLC, Wings Fund, Inc., and Cumorah Capital, Inc. (collectively, the "Majority Shareholders") are entitled to vote of a total of 53,831,009 shares or approximately 50.88% of the total issued and outstanding stock of Warp 9, Inc., a Nevada corporation ("Warp 9," "we," "us," "our," or the "Company"). The Majority Shareholders have adopted the following resolutions by written consent in lieu of a meeting pursuant to the General Corporation Law of the State of Nevada.

Andrew Van Noy, Chief Executive Officer and President

___________

WE ARE NOT ASKING YOU FOR A CONSENT OR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY.

___________

WARP 9, INC.

1933 Cliff Drive, Suite 11

Santa Barbara, California 93109

JULY 22, 2015

SHAREHOLDERS ACTION

The Majority Shareholders submitted their consents to the shareholder resolutions described in this Information Statement on or about July 9, 2015 to be effective upon satisfaction by the Company of all applicable filing and notification requirements of the Securities and Exchange Commission. As of July 9, 2015, the Majority Shareholders were entitled to vote of record 53,831,009 shares of the Company's common stock, par value $0.001 per share, or approximately 50.88% of the total issued and outstanding common stock of the Company. The remaining outstanding shares of common stock are held by approximately 1,870 other shareholders.

The Majority Shareholders consist of Zack Bartlett, a director and vice president of operations of the Company, William E. Beifuss, Jr., the former chairman of the Board of Directors and former secretary of the Company, Greg Boden, a director and the chief financial officer and secretary of the Company, Max Haws, Thunder Innovations, LLC, NewQuest Ventures, LLC, Wings Fund, Inc., and Cumorah Capital, Inc.

Holders of the common stock of record as of July 17, 2015 are entitled to submit their consent to the shareholder resolutions described in this information statement, although no shareholder consents other than those of the Majority Shareholders are required to be submitted in order for the resolution to be adopted.

We are not soliciting consents or proxies and shareholders have no obligation to submit either of them. Whether or not shareholders submit consents should not affect their rights as shareholders or the prospects of the proposed shareholder resolutions being adopted. The Majority Shareholders have consented to the shareholder resolutions described in this information statement. Other shareholders who desire to submit their consents must do so by August 27, 2015 and once submitted will not be revocable. The affirmative vote of the holders of a majority of the outstanding common stock of the Company is required to adopt the resolutions described in this Information Statement. Nevada law does not require that the proposed transactions be approved by a majority of the disinterested shareholders. A total of 105,790,195 shares of common stock will be entitled to vote on the Company's proposed transactions described in this Information Statement.

We Are Not Asking You for a Proxy and You are Requested Not to Send Us a Proxy.

-1-

THE COMPANY AND THE TRANSACTIONS

Proposed Shareholder Action

Our executive offices are located at 1933 Cliff Drive, Suite 11, Santa Barbara, California 93109, and our telephone number is (805) 964-3313. As described in the accompanying NOTICE OF ACTION TO BE TAKEN BY THE SHAREHOLDERS, the Company proposes to amend its Articles of Incorporation (the "Amendment") in order to (i) increase the number of authorized shares of the Company's common stock from 495,000,000, par value $0.001 per share, to 2,000,000,000, par value $0.001 per share, and (ii) change the name of the Company from Warp 9, Inc. to CloudCommerce, Inc.

The Board of Directors of the Company voted unanimously to implement the Amendment because the Board of Directors believes that an increase to the number of authorized shares of our common stock will allow us to meet our obligations pursuant to certain convertible notes, make future acquisitions, and raise the capital necessary for us to grow our business in the future. The Board of Directors also believes that the name CloudCommerce, Inc. more accurately reflects the direction in which our business is growing.

We are not expected to experience a material tax consequence as a result of the Amendment. Increasing the number of authorized shares of the Company's common stock may, however, subject the Company's existing shareholders to future dilution and subordination of their ownership and voting power in the Company.

Company Plans

We currently have no specific plans to issue the newly authorized common stock provided for in the Amendment. We may issue additional common stock from time to time in the future for customary purposes, including but not limited to meeting our obligations pursuant to certain convertible promissory notes and for the purposes of acquiring synergistic companies and raising capital.

Potential Anti-Takeover Effect

The additional shares of common stock that will become available for issuance upon the adoption of the resolutions could also be used by us to oppose a hostile takeover attempt or delay or prevent changes in control or management of the Company. For example, without further stockholder approval, the Board could strategically sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor the current Board. This proposal to increase the authorized common stock has been prompted by business and financial considerations and not by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at the Company). Nevertheless, stockholders should be aware that approval of the Amendment could facilitate future efforts by us to deter or prevent changes in control of the Company, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

-2-

Additional Information

Additional information regarding the Company, its business, its capital stock, and its financial condition are included in the Company's Form 10-K annual report and its Form 10-Q quarterly reports. Copies of the Company's Form 10-K for its fiscal year ending June 30, 2014, as well as the Company's Form 10-Q for the quarters ending September 30, 2014, December 31, 2014, and March 31, 2015, are available upon request to: Andrew Van Noy, Chief Executive Officer and President, Warp 9, Inc., 1933 Cliff Drive, Suite 11, Santa Barbara, California 93109. These reports are also available under the Company's name on the Securities and Exchange Commission's website at www.sec.gov.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the names of our executive officers and directors and all persons known by us to beneficially own 5% or more of the issued and outstanding common stock of Warp 9, Inc. at July 9, 2015. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares beneficially owned by a person and the percentage of ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or become exercisable within 60 days of July 9, 2015 are deemed outstanding even if they have not actually been exercised. Those shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. The percentage ownership of each beneficial owner is based on 105,790,195 outstanding shares of common stock. Except as otherwise listed below, the address of each person is c/o Warp 9, Inc., 1933 Cliff Drive, Suite 11, Santa Barbara, California 93109. Except as indicated, each person listed below has sole voting and investment power with respect to the shares set forth opposite such person's name.

|

Name and Address of Stockholder |

Number of Shares Owned(1) |

Percentage of Ownership |

|

Zach Bartlett, Director |

23,918,652 |

22.61% |

|

Andrew Van Noy, Chief Executive Officer and Chairman of the Board |

0 |

0.0% |

|

|

||

|

Greg Boden, Chief Financial Officer, Secretary and Director |

52,082 |

* |

|

All Current Executive Officers as a Group (Two Persons) |

52,082 |

* |

|

All Current Directors who are not Executive Officers as a Group |

23,970,734 |

22.65% |

|

|

||

|

Thunder Innovations, LLC |

14,893,905 |

14.08% |

* Represents beneficial ownership of less than 1%.

-3-

(1) Except as pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned. The total number of issued and outstanding shares and the total number of shares owned by each person does not include unexercised stock options, except those exercisable within 60 days of July 9, 2015.

OTHER MATTERS

The Board of Directors of the Company is not aware that any matter other than those described in this Information Statement is to be presented for the consent of the shareholders.

UPON WRITTEN REQUEST BY ANY SHAREHOLDER TO ANDREW VAN NOY, CHIEF EXECUTIVE OFFICER OF THE COMPANY, AT WARP 9, INC., 1933 CLIFF DRIVE, SUITE 11, SANTA BARBARA, CALIFORNIA 93109, TELEPHONE (805) 964-3313. A COPY OF THE COMPANY'S ANNUAL REPORT ON FORM 10-K WILL BE PROVIDED WITHOUT CHARGE.

-4-

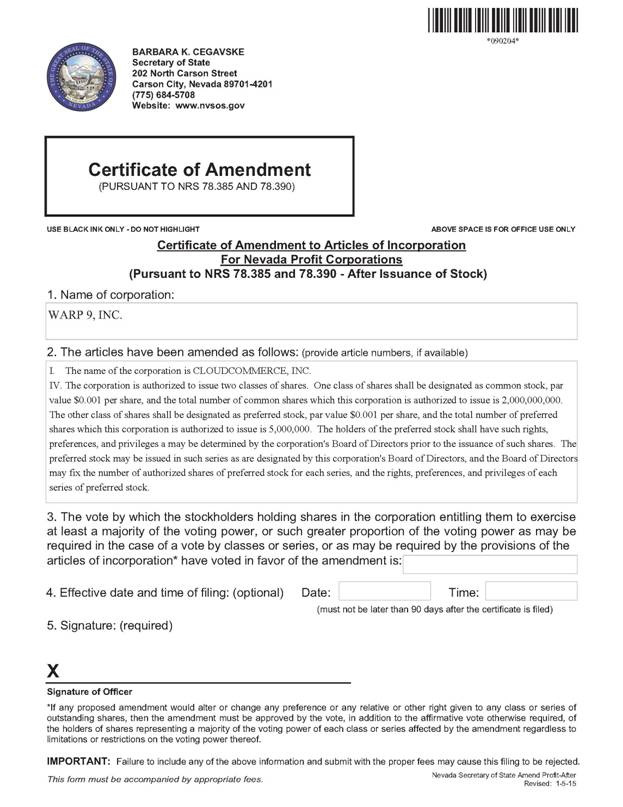

Exhibit A

Certificate of Amendment to Articles of Incorporation